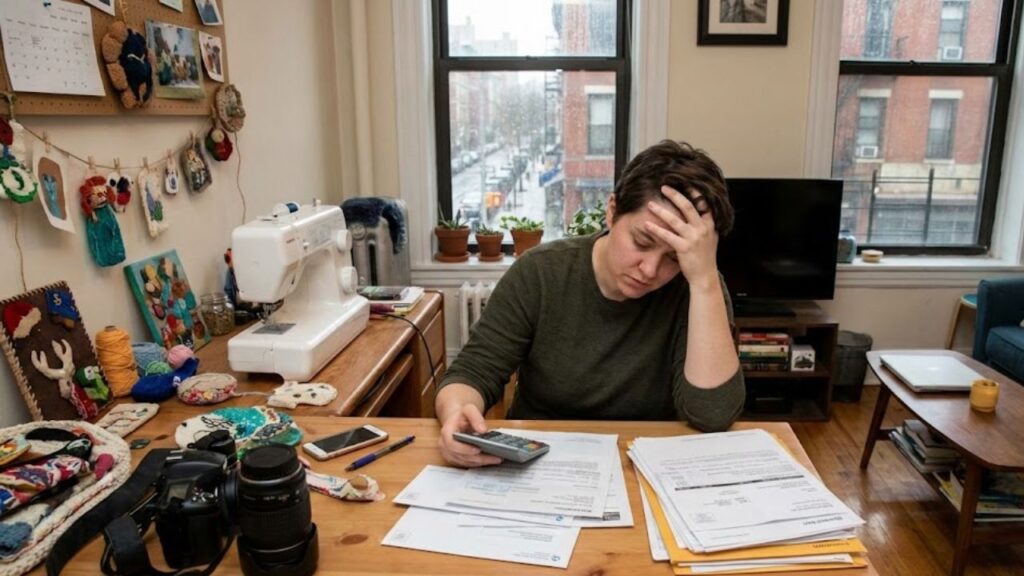

Renters across the United Kingdom are being warned that even small amounts of money earned from hobbies and side hustles could attract unexpected tax attention. Authorities say activities once seen as casual pastimes, from selling handmade goods to online freelancing, may now count as taxable income. For tenants already juggling rising rents and living costs, the message is clear: extra cash from a hobby is no longer invisible. Understanding how side income is viewed under UK tax rules is becoming essential to avoid surprise bills, penalties, or compliance issues later on.

Renters side hustle taxes draw closer scrutiny

UK tax authorities are paying closer attention to renters earning money on the side, especially as digital platforms make extra earnings visible and easier to track. Even occasional income from crafts, tutoring, or online sales can be flagged if it looks regular. Many renters assume small amounts fall under the radar, but reporting systems have improved, and digital income trails now leave little room for oversight. If your hobby starts to resemble a business, even informally, it could be classed as taxable. The key issue is intent and frequency, not just profit size, which often surprises casual hobby earners navigating the rules.

How hobby income taxes affect UK renters

For renters, hobby income can complicate finances faster than expected, particularly when it overlaps with benefits or housing support. The UK’s trading allowance offers some relief, but once earnings pass the threshold, self assessment duties may apply. This can mean setting aside money for tax, keeping records, and meeting deadlines. Some renters are caught out because they mix personal and side income without tracking it properly, creating unexpected tax bills later. Authorities stress that ignorance is not a defence, and income reporting rules apply regardless of whether the work feels informal or occasional.

7 phrases that people with lower IQs often use in everyday conversations, according to psychology

7 phrases that people with lower IQs often use in everyday conversations, according to psychology

Side hustle tax rules renters should know

Understanding side hustle tax rules can help renters avoid stress and penalties. HMRC generally looks at whether an activity is organised, repeated, and profit-driven. If it is, taxable activity tests may apply even if earnings are modest. Renters should also note that online platforms increasingly share data, making platform income checks more common. Keeping simple records, separating accounts, and knowing allowances can reduce risk. For many, a quick check or advice early on prevents costly compliance mistakes that can snowball into larger financial problems.

What this means for renters going forward

The bigger picture for UK renters is one of adjustment rather than panic. Authorities are not targeting hobbies for fun, but they are reinforcing that declared income matters in a more connected economy. As side hustles become a lifeline against rising costs, renters must balance opportunity with responsibility. Taking time to understand thresholds, allowances, and reporting can protect personal finances long term. The shift signals a future where even small earnings are expected to be transparent, making financial awareness essential for anyone supplementing rent with hobby income.

| Income Type | Typical Example | Tax Consideration |

|---|---|---|

| Craft sales | Online handmade goods | Counts toward trading allowance |

| Freelance work | Design or writing gigs | May require self assessment |

| Digital content | Streaming or subscriptions | Platform income reported |

| Tutoring | Private lessons | Regular income taxable |

Frequently Asked Questions (FAQs)

1. Do renters have to pay tax on small hobby income?

Yes, if earnings exceed the trading allowance or appear regular and profit-driven.

2. Is occasional side income automatically taxable?

It can be, depending on frequency, intent, and total annual earnings.

3. Do online platforms report income to authorities?

Many platforms now share income data with HMRC under reporting rules.

4. What should renters do to stay compliant?

Track earnings, understand allowances, and register for self assessment if required.